I recently discovered that IRS has a tax form 1099-G which is sent annually to those who received unemployment insurance compensation during the tax year. On the form there are boxes showing the amount of unemployment insurance compensation paid along with the amount state and federal income taxes withheld.

OED quickly responded to my inquiry about statewide 1099-G data for 2020. I then added to those totals the projected 2020 UI payroll contributions from employers found in the December 2020 Unemployment Insurance Trust Fund Forecast.

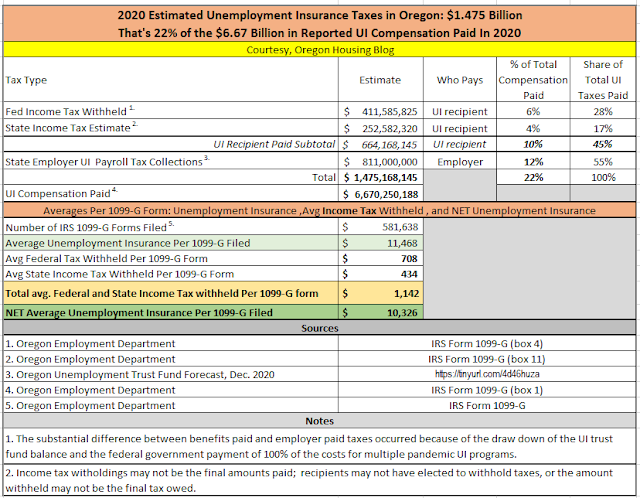

The result is the table pasted below showing the breakout of unemployment insurance taxes deducted or collected and the total number of 1099-G forms

The table also shows the gross average unemployment insurance compensation and net average unemployment insurance compensation per 1099-G form, after the subtraction of average federal and state income taxes

I also included a note that makes clear that the withheld amount of income tax may not be the final income tax obligation as some UI recipients chose not to withhold taxes or the amount of taxes withheld may not be the final tax obligation.

Some Observations:

- There were a total of 581,638 1009 G forms sent to UI recipients. (In December 2020 the Oregon civilian workforce count was 2,129,700 so 1099-G forms were sent to 27% of that count).

- Of the total of $1.475 billion in unemployment insurance related taxes, UI recipients paid an estimated 45%/$664 million with employers paying 55%/$811 million.

- Employer payroll taxes were only 12% of the $6.67 Billion in unemployment compensation paid. This is because the federal government paid 100% of the cost for multiple pandemic UI programs, and because the trust fund balance was spent down in 2020. Tax rates for employers this year have increased and are likely to do so in future years to replenish what is intended to be a self supporting trust fund.

- UI recipients had an average of $708 in federal income taxes withheld and $434 in state income taxes withheld, for a total of $1,142 in federal and state income tax per 1099-G form.

- The average federal tax withheld from UI compensation per 1099-G form was 6%, and the state average federal income tax withheld was 4%.

- The average UI compensation per 1099-G form filed was $11,468. Subtracting out withheld federal and state income taxes the net average after tax UI compensation per 1099-G form was $10,326.

Originally created and posted on the Oregon Housing Blog.

No comments:

Post a Comment